Portfolio growth

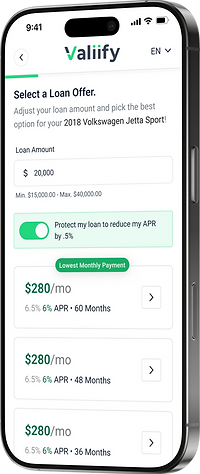

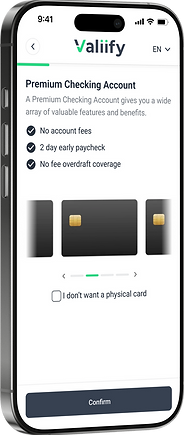

Attract more users and convert them faster with a seamless experience that reduces friction and increases funded accounts and approved loans.

Increase revenue

Free up staff for high-impact work and uncover new deposit and lending opportunities through smarter cross-sell insights.

Speed to market

Launch new products and scale services faster with a nimble, modular platform built to adapt quickly to changing customer needs and market demands.

Transform outdated banking workflows into actionable growth drivers

DIGITAL ACCOUNT OPENING SOLUTION

Make onboarding effortless from mobile to in-branch.

Deliver a seamless experience that turns more applicants into customers with a digital account opening solution built for speed, compliance, and growth.

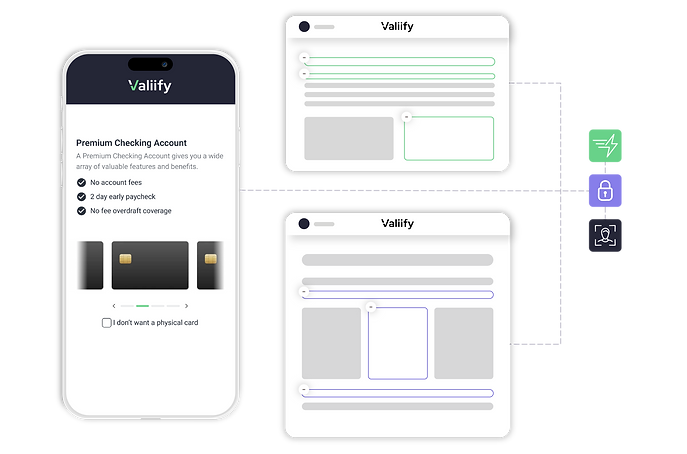

Modern infrastructure for trust and reliability

A unified, modular platform for digital and in-branch origination—built to scale with your institution, simplify compliance, and support long-term growth.

Unified origination

Singular platform for in-branch and digital, deposit and loan origination.

Modular and scalable

Modular Platform designed for maximum configurability.

Compliance ready

Software with compliance, deliverability, and availability in mind.

Future proof

Cloud-native architecture, Microservices support, and extensible API services.

Built by Bankers, for Bankers

Valiify was built by bankers tired of technology that didn’t fit. We replace abandoned applications, compliance headaches, and half‑funded accounts with tools that finish what they start because we’ve stood exactly where you’re standing.

Our mission is simple: banking technology made by people who know your world, driving growth you can measure, and connections you can feel.